OLYMPIA…Today the Seattle City Council repealed the “head tax” it unanimously enacted less than a month ago despite widespread and deafening opposition. Senate Republican Leader Mark Schoesler, R-Ritzville, and Sen. Steve O’Ban, R-University Place, responded to the repeal by reinforcing their determination to continue with legislation that would clearly make such a tax illegal statewide and would motivate employers to locate in Washington’s distressed counties.

Senator Schoesler:

“I’m glad most members of the Seattle City Council had a flash of common sense and repealed their tax on jobs so soon after forcing it through. But it appears they only bowed to the reality of an expensive political battle, not that they realized they’d made a critical mistake. Today the supporters of the referendum to repeal the anti-job tax announced that they collected twice the number of signatures necessary to qualify the repeal referendum for the November ballot.

“My bill will make it clear that any future taxing of jobs will be illegal. It’s wrong for Seattle, or any other city in Washington, to undermine the jobs working families depend on simply because of political ideology.

“Three Democrat senators and a Democrat state representative have said they’ll support my bill if allowed to vote on it. The support of only one more House Democrat should give us a constitutional majority to protect Washington’s jobs. Whatever the motivation of the council, I hope its repeal of the ‘head tax’ inspires another Democrat lawmaker to be that final vote.”

Click here to read the Senate Republican leadership blog regarding the “head tax” repeal.

Sen. O’Ban:

“Even though the people won on this, it won’t be long before the Seattle City Council launches another attack on employers. Those companies need to know that business-friendly rural areas welcome them and need their jobs. And, since Seattle’s over-taxation is making it too expensive for the working class to live there, families would benefit from relocating to areas that have low housing costs, a low cost of living, uncongested roads and safer neighborhoods.

“My ‘head tax credit’ is designed to reward, rather than punish, employers for family-wage job growth. The biggest contributor to homelessness is job loss. The first step in addressing homelessness should be to maximize job growth across the state. Jobs give dignity to men and women. Jobs change lives.

“Let me be very clear. The ‘head tax’ was literally a tax on jobs since it levied a tax on each job provided by the affected employers. Councilmember Sawant even called Jeff Bezos ‘the enemy.’ I found it ironic that during her speech today, she also mentioned grocery workers in her list of those who are rent-burdened even though her tax would have driven grocers to close and lay off those same workers. Under the ‘head tax,’ the grocery workers wouldn’t be rent-burdened any more. They’d be homeless.”

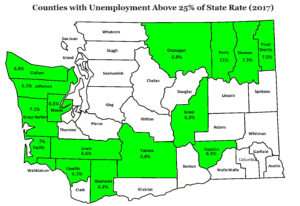

The tax credit proposed by O’Ban would provide a $275 business and occupation tax credit to employers for each new qualifying job they create in counties with an unemployment rate in the preceding year that exceeds the statewide unemployment rate by 25 percent. To qualify for the credit, a job position would have to pay more than the county’s average wage.

Counties initially affected by the tax credit include Clallam, Cowlitz, Ferry, Franklin, Grant, Grays Harbor, Jefferson, Lewis, Mason, Okanogan, Pacific, Pend Oreille, Stevens, Skamania, Wahkiakum and Yakima.

Listen to the “Elephant in the Dome” podcast about the June 12 repeal of the Seattle ‘head tax.’

Podcast: Play in new window | Download