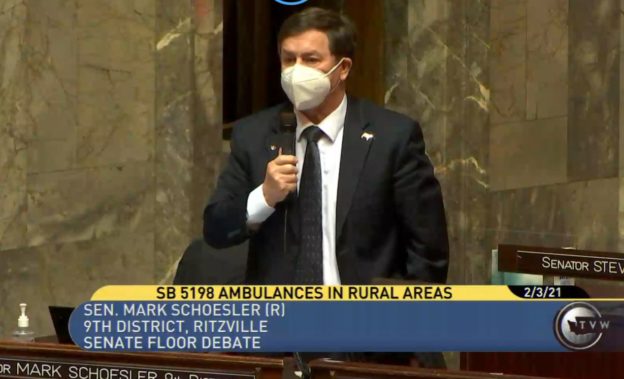

A Democrat-sponsored “carbon cap and tax” bill passed tonight by the Senate Ways and Means Committee would punish Washington citizens and companies, argues 9th District Sen. Mark Schoesler.

The Ways and Means Committee voted 13-10 to pass Senate Bill 5126. Schoesler, a member of the panel, voted against the proposal.

“This is another bill that would punish people and companies, without any proof of even helping the climate,” said Schoesler, R-Ritzville. “The bill is called the Climate Commitment Act, but I’m afraid the only thing it will commit Washingtonians to is handing over more of their hard-earned money for an environmental plan that won’t work.”

Schoesler said many residents in his legislative district would not qualify for any of the exemptions from the proposed tax.

“This cap-and-tax bill offers several types of exemptions, except for rural communities, middle-class families or individuals, and small businesses. This is a very unfair, inconsiderate and inconsistent bill to people in the 9th District and other rural districts in our state,” said Schoesler.

Under this bill, the state would set statewide emissions limits. Companies could purchase a “permit to emit” at an auction run by the Department of Ecology. The proposal calls for allowable emissions to decline each year.

“If this bill becomes law, it will tax people to the tune of $500 million just to have a permit to emit,” said Schoesler, “and judging by the 75-page fiscal note for this bill, this ‘cap and tax’ bill is extremely complicated, which is never a good thing for taxpayers.”

Schoesler said when the Ways and Means Committee held a public hearing on the bill, one opponent testified that a 2019 analysis found carbon emissions from oil and gas have actually increased since a cap-and-trade policy began in California.

Senate Bill 5126 now goes to the Senate Rules Committee for further consideration.